Welcome to the Waterfront Wonderland Blog

Welcome to the

Waterfront Wonderland Blog

Transaction Broker Relationship

Transaction Broker Relationship:

A broker who provides limited representation to a buyer, a seller, or both, in a real estate transaction, but does not represent either in a fiduciary capacity or as a single agent. In a transaction broker relationship, a buyer or seller is not responsible for the acts of a licensee. I will be working with you as a Transaction Broker relations ship.

Additionally, the parties to a real estate transaction are giving up their rights to the undivided loyalty of a licensee. This aspect of limited representation allows a licensee to facilitate a real estate transaction by assisting both the buyer and the seller, but a licensee cannot work to represent one party to the detriment of the other party when acting as a transaction broker to both parties.

In Florida, all licensees are presumed to be transaction brokers unless another relationship is established in writing. This is the most prevalent form of brokerage relationship in our state. In a transaction broker relationship the broker (and their sales associates and broker associates) owes these duties:

• Dealing honestly and fairly

• Accounting for all funds

• Using skill, care, and diligence in the transaction

• Disclosing all known facts that materially affect the value of residential real property and are not readily observable to the buyer

• Presenting all offers and counteroffers in a timely manner, unless a party has previously directed the licensee otherwise in writing

• Limited confidentiality, unless waived in writing by a party. This limited confidentiality will prevent disclosure that the seller will accept a price less than the asking or listed price, that the buyer will pay a price greater than the price submitted in a written offer, of the motivation of any party for selling or buying property, that a seller or buyer will agree to financing terms other than those offered, or of any other information requested by a party to remain confidential

• Any additional duties that are mutually agreed to with a party

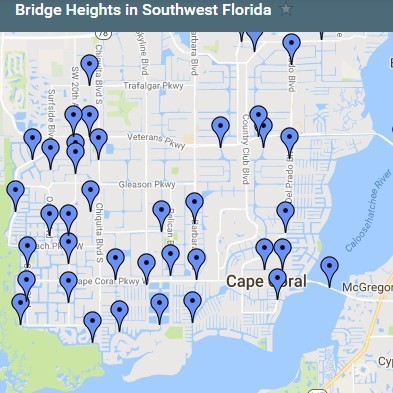

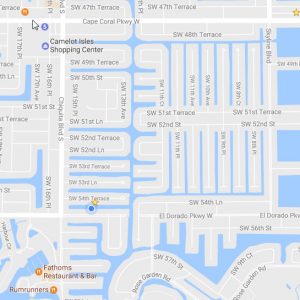

Lee County Water Initiative

Contact Drake Bliss at 239-910-1948 for help in Buying and Selling real estate in Southwest Florida.

16 Questions to Ask When Choosing a Lender

Contact Drake Bliss at 239-910-1948 for help in locating a lender for your property purchase.

16 Questions to Ask When Choosing a Lender

Loan terms, rates and products can vary significantly from one lending company to the next. Plus, how do you handle closings in the age of COVID-19?

General questions:

- What are the most popular mortgages you offer? Why are they so popular?

- Are your rates, terms, fees and closing costs negotiable?

- Do you offer discounts for inspections, home ownership classes or automatic payment set-up?

- Will I have to buy private mortgage insurance? If so, how much will it cost and how long will it be required?

- What escrow requirements do you have?

- What kind of bill-pay options do you offer?

- Do you do remote closings?

- Explain the process of closing with social distancing.

Loan-specific questions:

- What would be included in my mortgage payment (homeowner*s insurance, property taxes, etc.)?

- Which type of mortgage plan would you recommend for my situation?

- Who will service this loan*your bank or another company?

- How long will the rate on this loan be locked-in? Will I be able to obtain a lower rate if the market rate drops during the lock-in period?

- How long will the loan approval process take?

- How long will it take to close the loan?

- Are there any charges or penalties for prepaying this loan?

- How much will I be paying in total over the life of this loan?

Source: National Association of Realtors®

Contact Drake Bliss at 239-910-1948 for help in locating a lender for your property purchase.

8 Dos and Don’ts of Owning a Vacation Rental

Contact Drake Bliss at 239-910-1948 for help in locating your new vacation rental home for purchase in Southwest Florida.

8 Dos and Don’ts of Owning a Vacation Rental

Are you considering a vacation home purchase that will produce valuable rental income when you’re not using the property? If so, check out these dos and don’ts to get the most out of your financial investment.

DO: Create a financial plan. This will help you predict the potential revenue and expense of owning a rental property.

DO: Work with a knowledgeable Realtor when buying or selling. A good agent can help you find a property in a good location with the best rental potential.

DO: Get to know your home. Carefully check all parts of the home and repair and replace items that need it.

DO: Choose a property manager carefully. Check their reputation in the area, then ask how they’ll: Maintain the home so it stays in good condition, communicate with you and maximize your revenue.

DON’T: Ignore preventive maintenance. It’s better to fix or replace that aging water heater or HVAC system now than have it break during a renter’s stay.

DO: Be strategic about using the home yourself. If your goal is to maximize rental income, stick to planning your stay during the off season.

DO: Plan to reinvest in the home. Figure you may have to spend 1% of the property value each year on maintenance.

DO: Be realistic about pricing. Research area rental rates and don’t overprice. Your ultimate goal is to make a reasonable profit and that will require a high occupancy rate.

Sources: entrepreneur.com, sfgate.com, Morris Invest, blogs.netintegrity.net

Contact Drake Bliss at 239-910-1948 for help in locating your new vacation rental home for purchase in Southwest Florida.

For Sale by Owner (FSBO) Free eBook

Contact Drake Bliss at 239-910-1948 for help selling your home, condo or lot in Southwest Florida For Sale By Owner (FSBO).

Contact Drake Bliss at 239-910-1948 for help selling your home, condo or lot in Southwest Florida For Sale By Owner (FSBO).

Transaction Broker Relationship

Transaction Broker Relationship: A broker who provides limited representation to a buyer, a seller, or both, in a real estate transaction, but does not represent either in a fiduciary capacity or as a single agent. In a transaction broker relationship, a buyer or...

Lee County Water Initiative

Contact Drake Bliss at 239-910-1948 for help in Buying and Selling real estate in Southwest Florida.

16 Questions to Ask When Choosing a Lender

Contact Drake Bliss at 239-910-1948 for help in locating a lender for your property purchase. [pdf-embedder url="https://www.waterfrontwonderland.com/wp-content/uploads/securepdfs/2020/12/16-Questions-to-Ask-When-Choosing-a-Lender.pdf" title="16 Questions to Ask When...

8 Dos and Don’ts of Owning a Vacation Rental

Contact Drake Bliss at 239-910-1948 for help in locating your new vacation rental home for purchase in Southwest Florida. [pdf-embedder url="https://www.waterfrontwonderland.com/wp-content/uploads/2020/12/8-Dos-and-Donts-of-Owning-a-Vacation-Rental.pdf"...

For Sale by Owner (FSBO) Free eBook

Contact Drake Bliss at 239-910-1948 for help selling your home, condo or lot in Southwest Florida For Sale By Owner (FSBO). [pdf-embedder url="https://www.waterfrontwonderland.com/wp-content/uploads/2020/09/For-Sale-By-Owner-eBook.pdf" title="For Sale By Owner...