Welcome to the Waterfront Wonderland Blog

Welcome to the

Waterfront Wonderland Blog

Charlotte County Property Fraud Alert Registration

Charlotte County Property Fraud Alert Registration

The Charlotte County Property Fraud Alert system is a free service that alerts property owners when a document is filed using their name. You will get a notification email when documents such as mortgage, deed or other land document is recorded in your name in Charlotte County’s official records. The Alert Notifications are emailed within 24 hours of the document being recorded.

Sign up and start protecting your most valuable investments.

Visit this website for more information on setting up an alert.

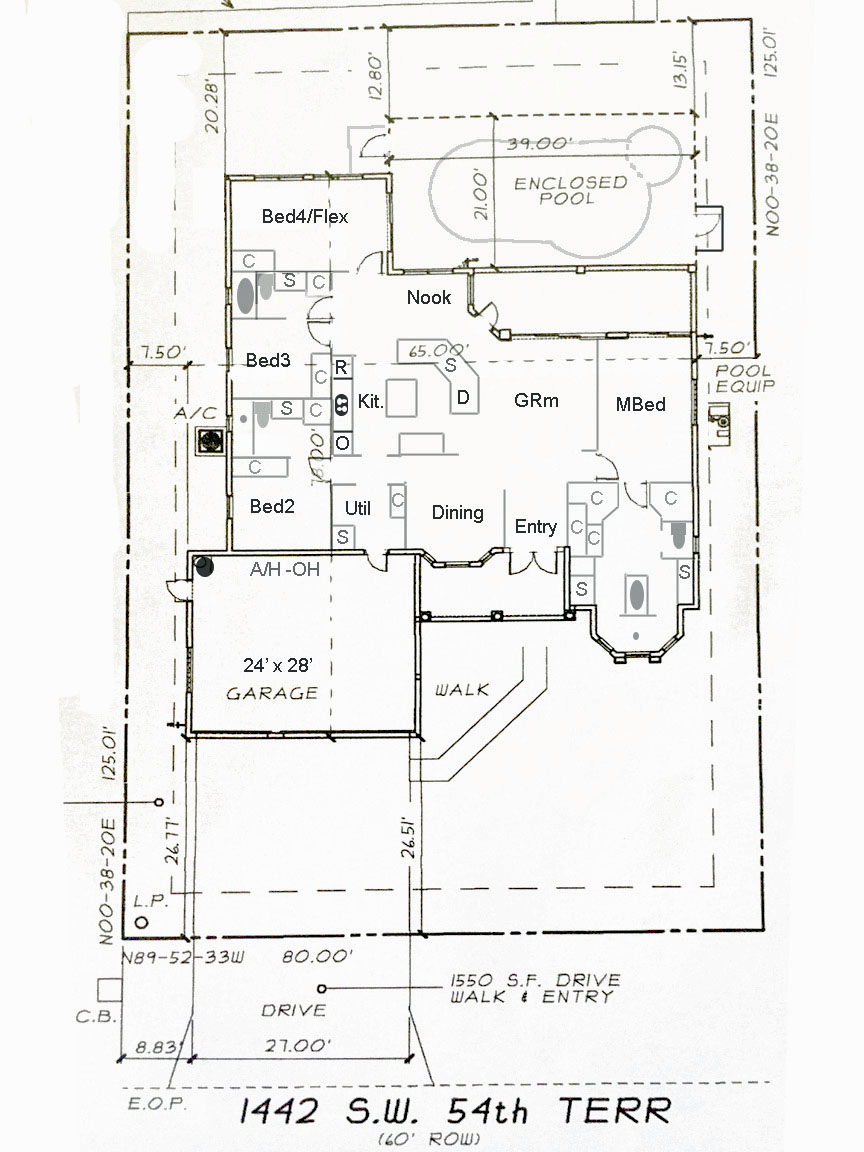

$1,350,000 – 1442 SW 54th Terrace, Cape Coral, FL 33914

Pending Sale - Call for Information

Contact Drake Bliss at 239-910-1948 to see this property today.

1442 SW 54th Terrace, Cape Coral, FL 33914

CAPE CORAL UNIT 64 BLOCK 4501 PLAT

BOOK 21 PAGE 83 LOTS 14 AND 15

MLS C7487143

Virtual Tour Link

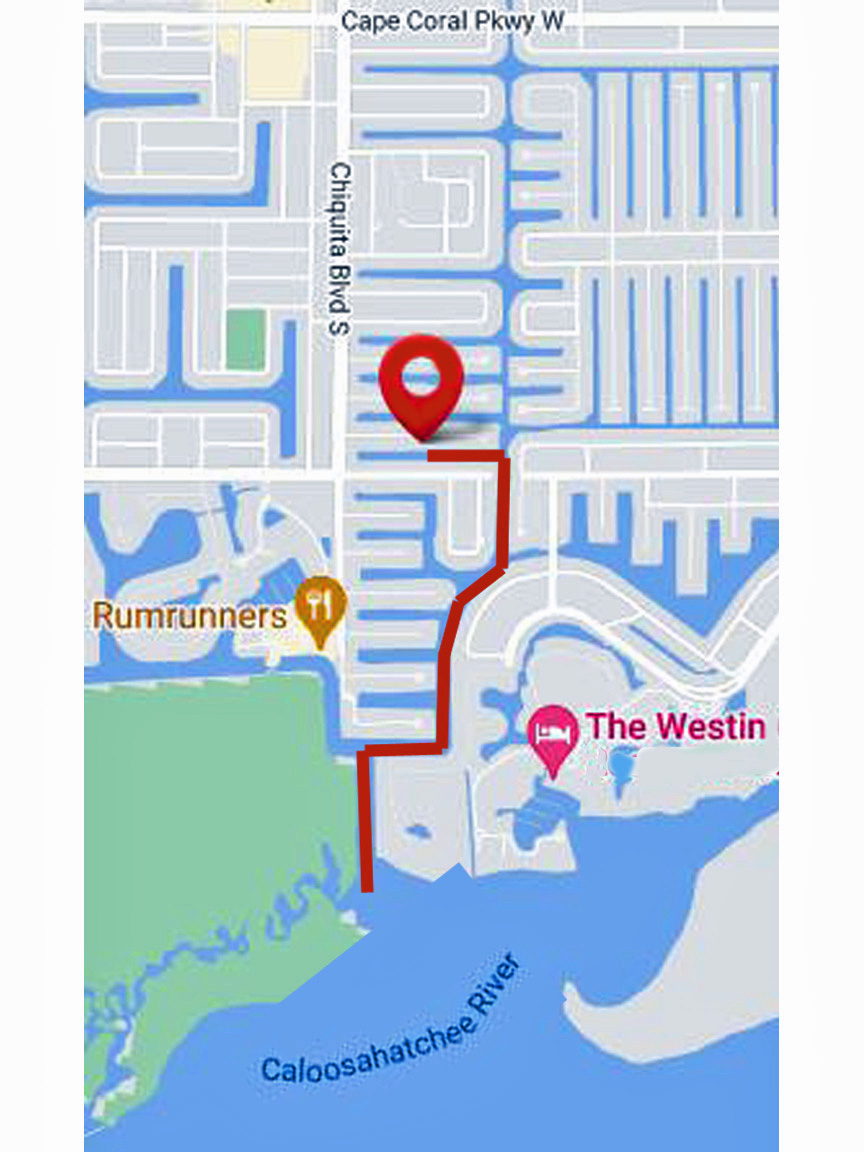

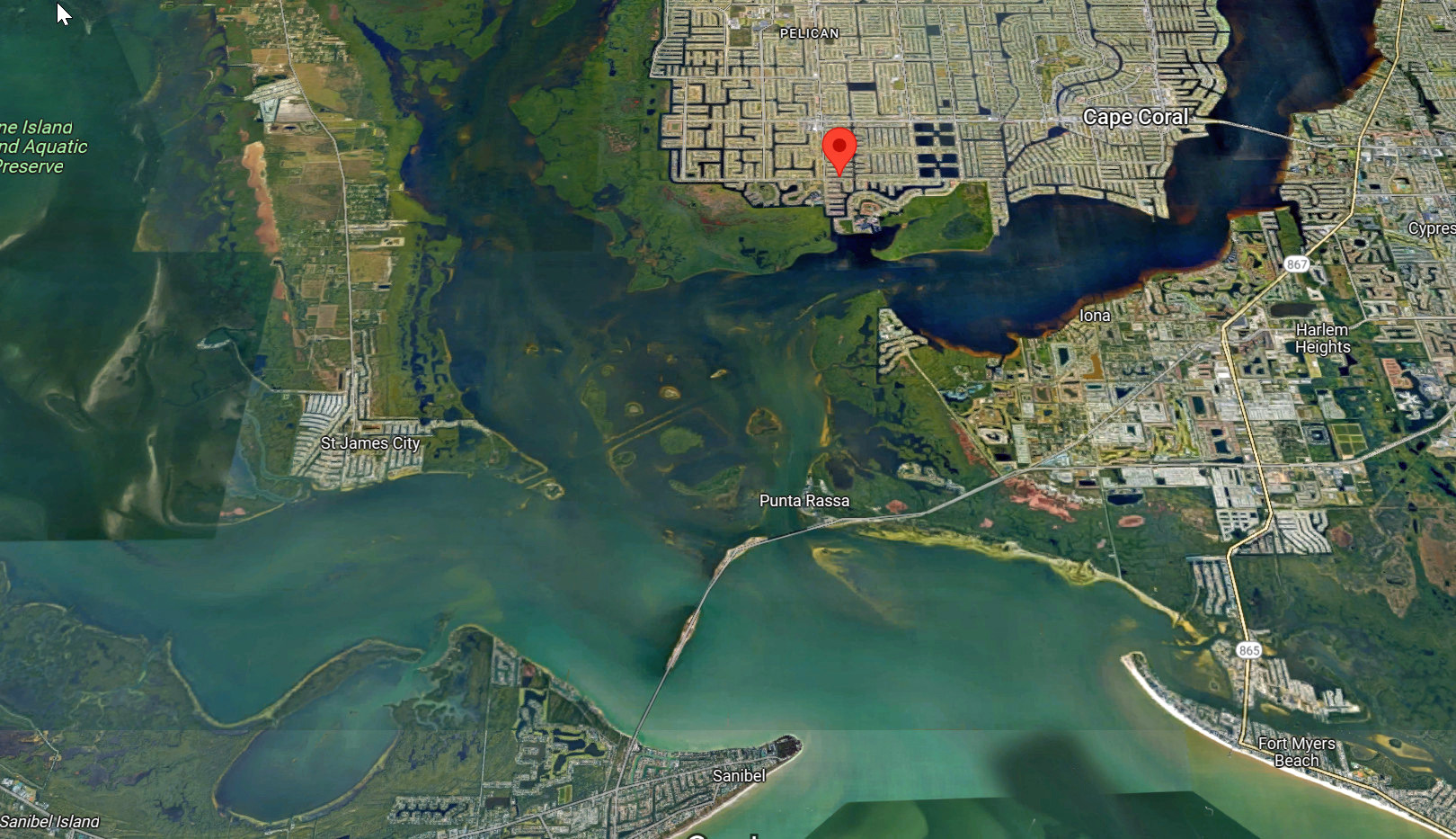

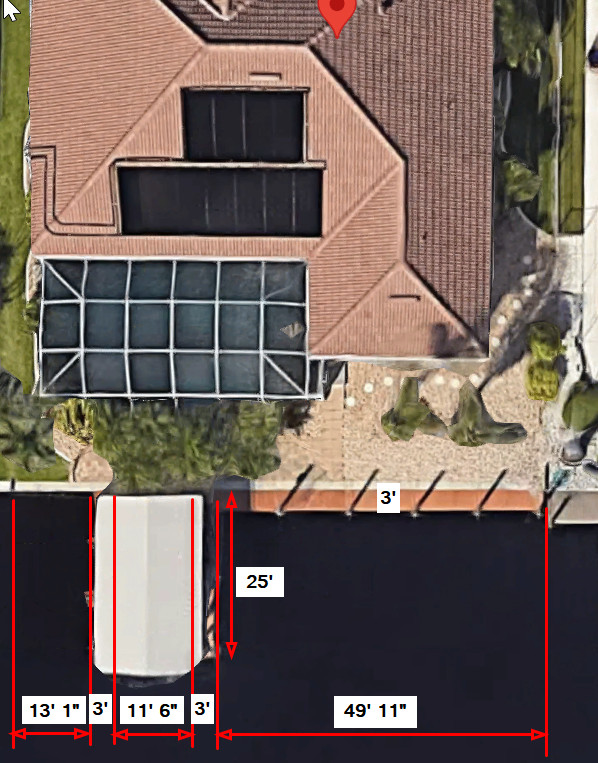

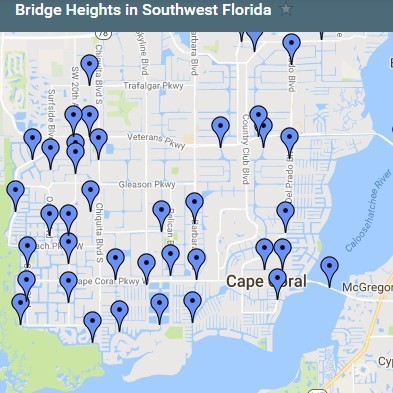

This 2006 direct Gulf Access, No Bridges, No Lock, Deep Water Canal home is 4 bedroom, 3 bath, oversize 3 car garage, pool and spa has all the features you are looking for. The home will exceed your expectations! Situated in Cape Coral’s most sought after, sailboat-access, canal neighborhoods on a cul-de-sac street in the southwest area of the city and very near Cape Harbor. The open floor plan home is approximately 2,563 square feet. In addition to the 4 bedrooms and 3 baths, there is a dining room, living room, large kitchen with dining nook, and a laundry room. Bedroom 4 is large enough to alternatively use as an office, hobby/flex room, man-cave, or any other use you can think of! The custom kitchen has 42-inch wood cabinets, the lower cabinets have pull-out shelving, granite counter tops and tumbled stone back-splash, and a kitchen island with wine rack and bookshelf. The stainless steel, double bowl, sink has a disposal, faucet with pull down sprayer, and a Culligan filtered water spigot. There is a 5 burner, built-in cook top, wall oven with microwave combination, stainless steel dishwasher, and stainless refrigerator. Additional features: travertine window sills, blinds, crown molding, 2022 water heater, a 2023 air handler, whole house water filtration system. Exterior features: concrete tile roof, large oversize 3 car garage, pull-down attic access, expansive paver driveway, whole house hurricane window protection, and underground electrical service. At an elevation of 9.7 feet, this home had no flood damage from hurricane Ian. This home is on city water and sewer, and irrigation water for landscaping. Plus, this home is conveniently located near groceries, drug stores, banks, medical offices, local shops and restaurants. Make your plans to see this great home!

Contact Drake Bliss at 239-910-1948 to see this property today!

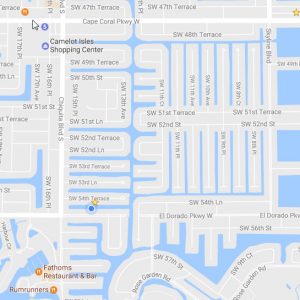

Property Location

1442 SW 54th Terrace, Cape Coral, FL 33914

Contact Form

Lee County Property Fraud Alert Registration

Lee County Property Fraud Alert Registration

The Lee County Property Fraud Alert system is a free service that alerts property owners when a document is filed using their name. You will get a notification email when ocuments such as mortgage, deed or other land document is recorded in your name in Lee County’s official records. The Alert Notifications are emailed within 24 hours of the document being recorded.

Sign up and start protecting your most valuable investments.

Visit this website for more information on setting up an alert.

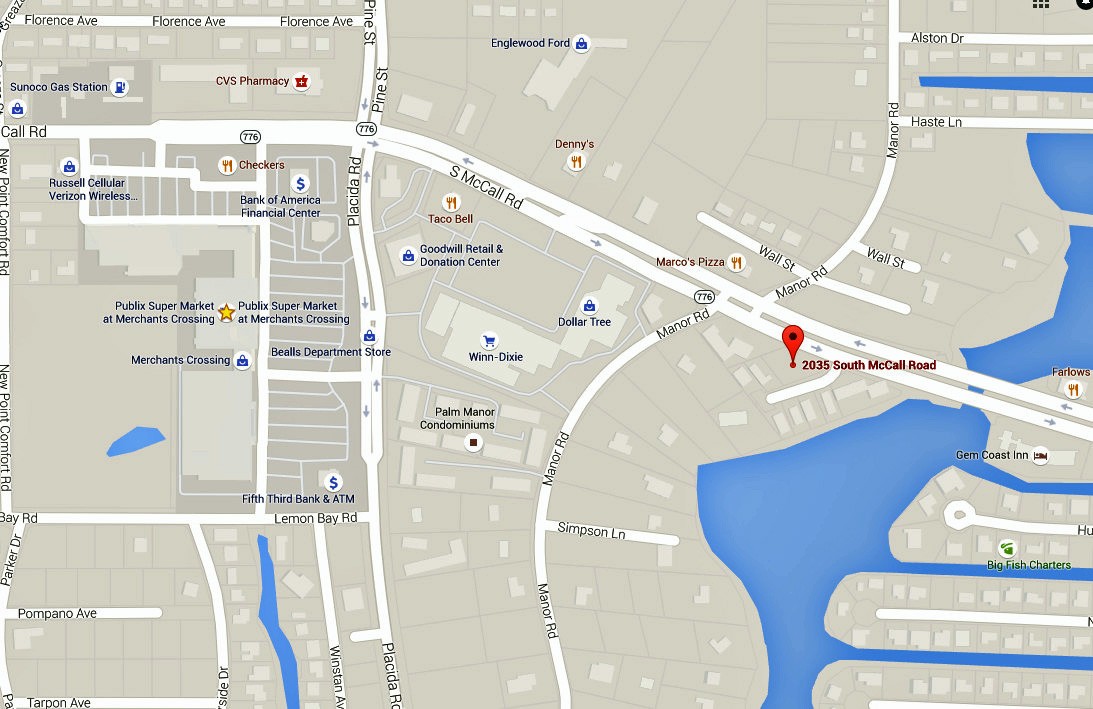

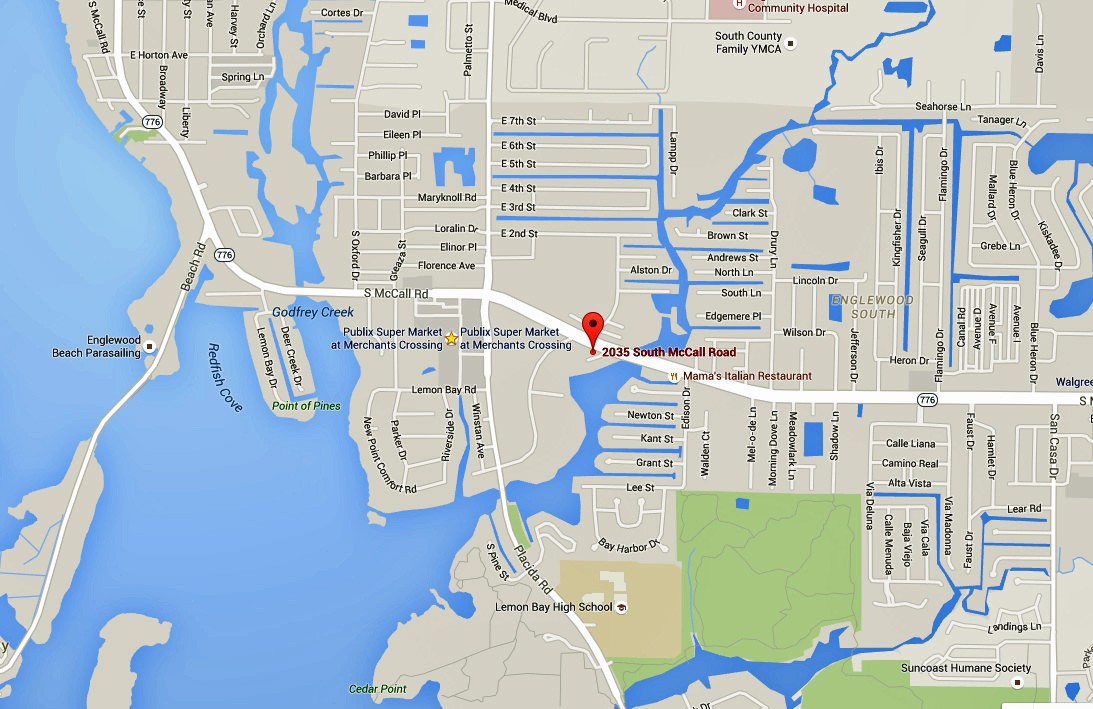

$329,000 – 2035 S McCall Road, Englewood, FL 34224

Contact Drake Bliss at 239-910-1948 to see this property today.

2035 S McCall Road, Englewood, FL 34224

MLS C7486270

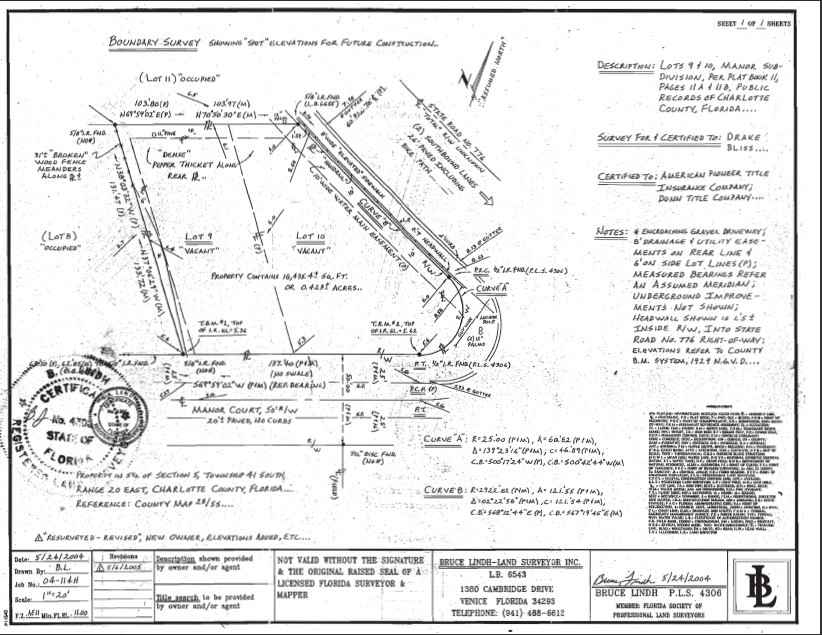

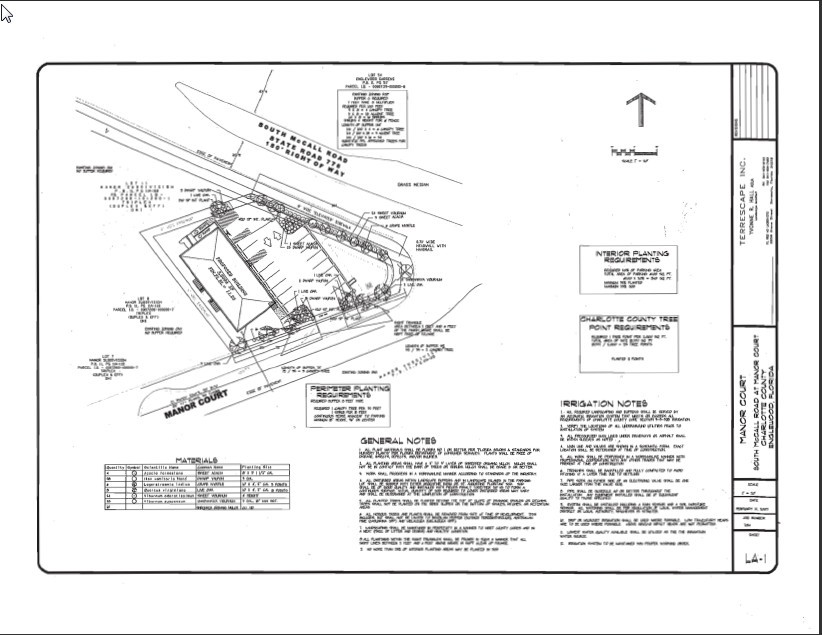

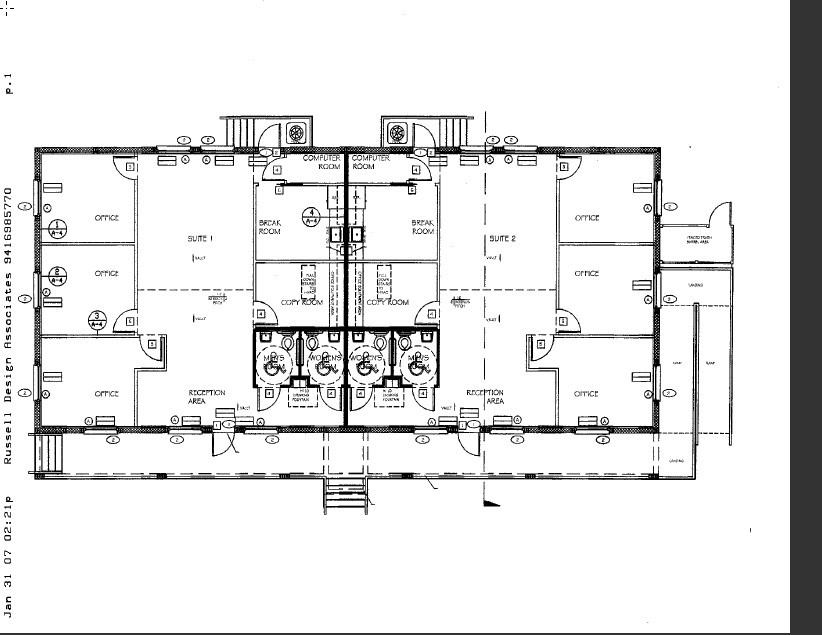

Owner Financing Available on this Prime Commercial Lot in Englewood. This is the perfect place for your new business. This is a prime 18,000+ square foot 2-lot McCall Road location with OMI Zoning. Owner has old engineered site plan and architectural drawing for a Key West style office building.

Seller Financing, See Terms Below.

City water and sewer is available.

Contact Drake Alan Bliss, Licensed Real Estate Broker

at 239-910-1948 to see this property today!

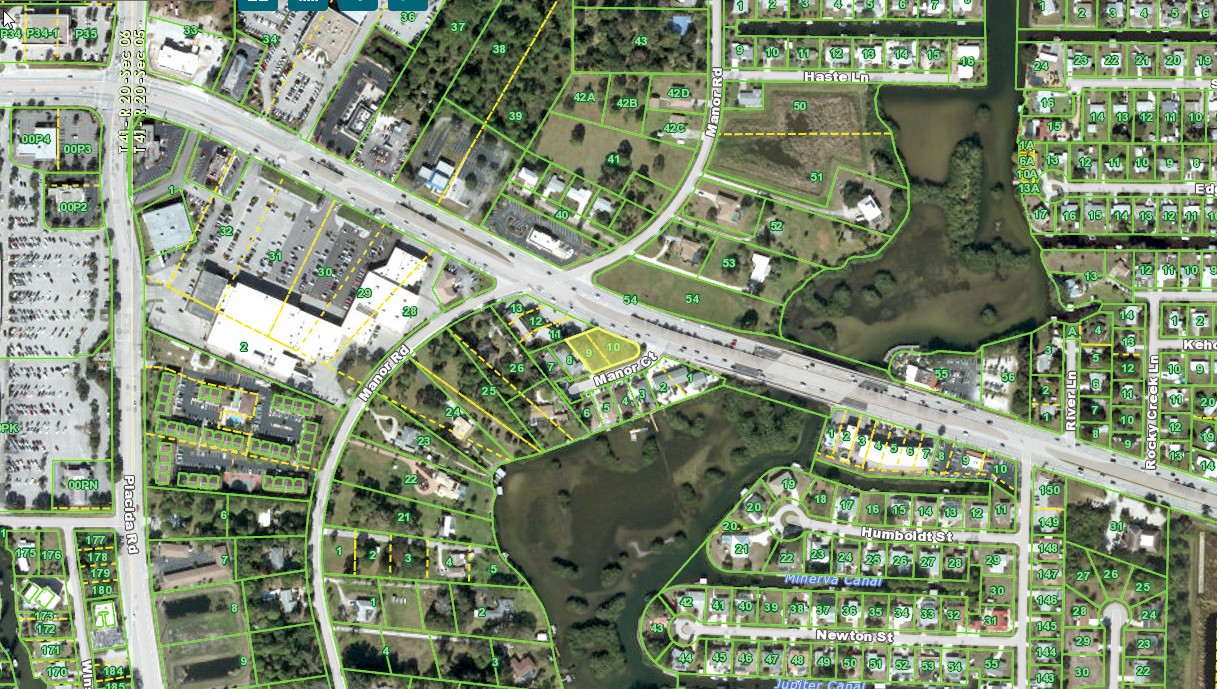

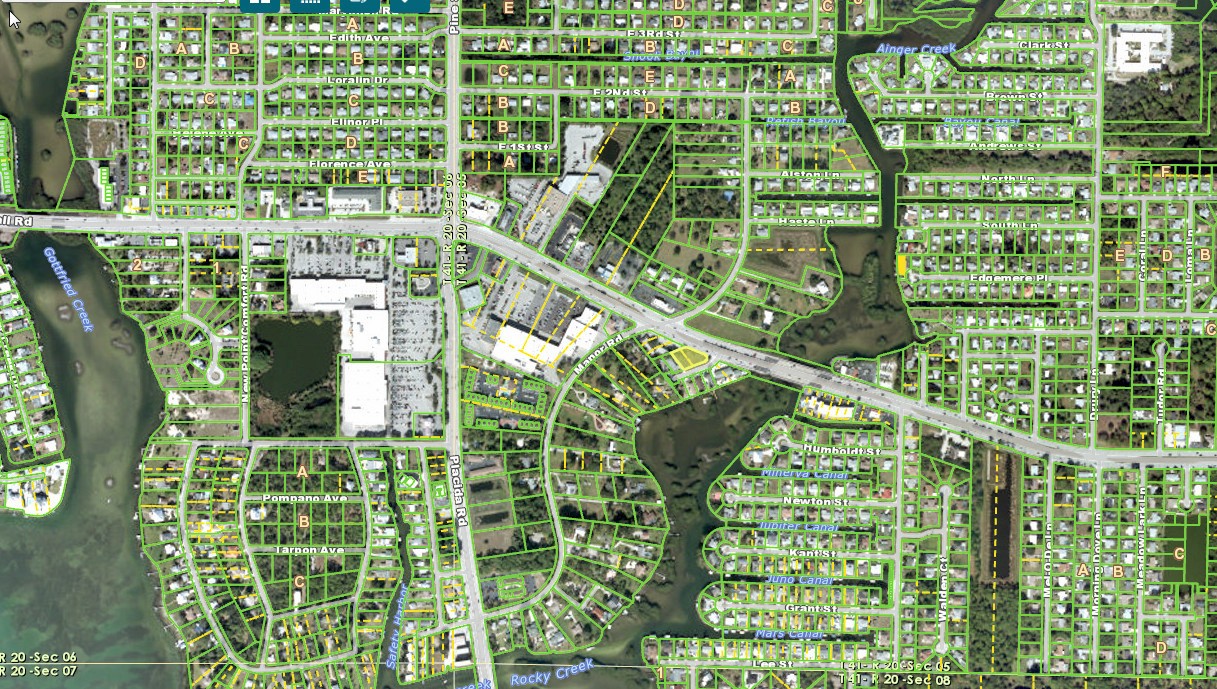

Property Location

2035 S McCall Road, Englewood, FL 34224

OMI Zoning Uses

Contact Drake Bliss at 239-910-1948 to see this property today!

Engineered Building Plans/Survey

Contact Drake Bliss at 239-910-1948 to see this property today!

Seller Financing Terms

Contact Drake Bliss at 239-910-1948 to see this property today!

Contact Form

FEMA Flood Risk Rating 2.0

FEMA is updating the National Flood Insurance Program’s (NFIP) risk rating methodology through the implementation of a new pricing methodology called Risk Rating 2.0. The methodology leverages industry best practices and cutting-edge technology to enable FEMA to deliver rates that are actuarily sound, equitable, easier to understand and better reflect a property’s flood risk.

Charlotte County Property Fraud Alert Registration

Charlotte County Property Fraud Alert Registration The Charlotte County Property Fraud Alert system is a free service that alerts property owners when a document is filed using their name. You will get a notification email when documents such as mortgage, deed or...

$1,350,000 – 1442 SW 54th Terrace, Cape Coral, FL 33914

Pending Sale - Call for Information Contact Drake Bliss at 239-910-1948 to see this property today. 1442 SW 54th Terrace, Cape Coral, FL 33914CAPE CORAL UNIT 64 BLOCK 4501 PLATBOOK 21 PAGE 83 LOTS 14 AND 15MLS C7487143 Virtual Tour Link This 2006 direct Gulf...

Lee County Property Fraud Alert Registration

Lee County Property Fraud Alert Registration The Lee County Property Fraud Alert system is a free service that alerts property owners when a document is filed using their name. You will get a notification email when ocuments such as mortgage, deed or other land...

$329,000 – 2035 S McCall Road, Englewood, FL 34224

Contact Drake Bliss at 239-910-1948 to see this property today. 2035 S McCall Road, Englewood, FL 34224MLS C7486270 Owner Financing Available on this Prime Commercial Lot in Englewood. This is the perfect place for your new business. This is a prime 18,000+ square...

FEMA Flood Risk Rating 2.0

EMA Flood Risk Rating 2.0: Equity in Action FEMA is updating the National Flood Insurance Program's (NFIP) risk rating methodology through the implementation of a new pricing methodology called Risk Rating 2.0. The methodology leverages industry best practices and...